-

Web sayfası bildirimcisi

- EXPLORE

-

Blogs

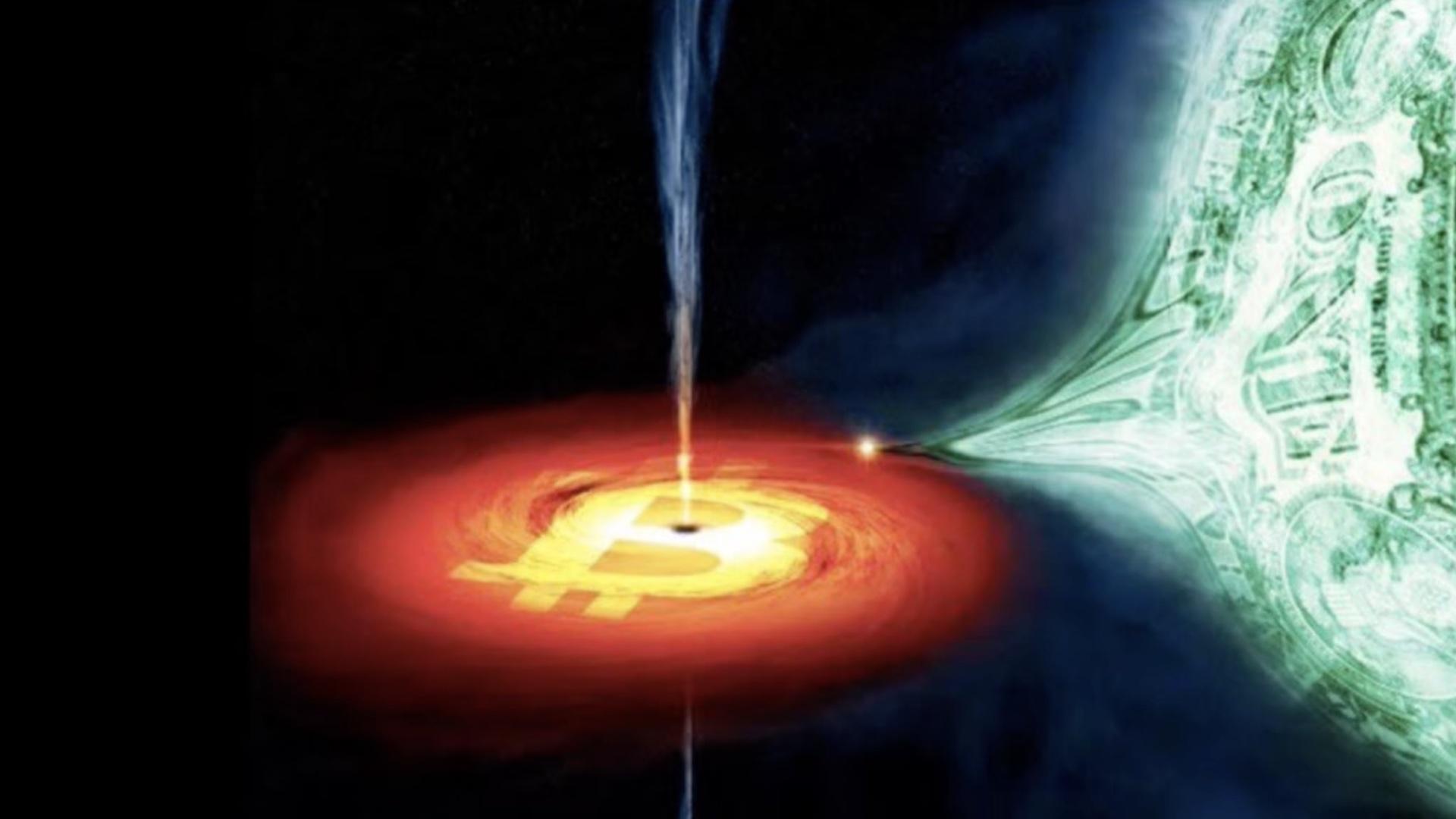

Bitcoin: The Black Hole of Finance

In the vast expanse of the digital universe, a singular force has emerged, reshaping the landscape of finance and challenging the very notion of currency as we know it. Bitcoin, often hailed as digital gold, has transcended mere speculation to become a gravitational force, pulling in fiat currencies from around the globe like a relentless black hole.

Since its inception, Bitcoin has captivated the imagination of both technologists and financiers alike. Born out of the ashes of the 2008 financial crisis, Bitcoin was envisioned as a decentralized alternative to traditional banking systems—a currency by the people, for the people. What started as an experiment in cryptography has evolved into a financial juggernaut, disrupting industries, captivating investors, and reshaping the global economic order.

One of the most striking aspects of Bitcoin's rise to prominence is its relentless accumulation of value. Like a black hole, Bitcoin seems to devour traditional fiat currencies, drawing them into its gravitational pull and converting them into digital wealth. While fiat currencies fluctuate with the whims of governments and central banks, Bitcoin remains immutable, its scarcity encoded into its very DNA through a fixed supply of 21 million coins.

The immutable nature of Bitcoin's blockchain—the underlying technology that records all transactions—ensures transparency and security, making it resistant to censorship and manipulation. From the moment it started recording blocks, every transaction on the Bitcoin network has been etched into the annals of history, forming an indelible ledger of value transfer.

As traditional currencies falter under the weight of inflation and economic uncertainty, Bitcoin emerges as a beacon of stability and trust. Its decentralized nature means that no single entity controls its fate, making it immune to the geopolitical tensions and economic crises that plague fiat currencies.

But perhaps the most compelling argument for embracing Bitcoin lies in its potential for exponential growth. Unlike traditional assets, which are subject to the whims of markets and central banks, Bitcoin's scarcity ensures that its value can only increase over time. With each passing day, more individuals and institutions recognize the intrinsic value of Bitcoin as a store of wealth and a hedge against inflation.

For those who have yet to dip their toes into the world of cryptocurrencies, now is the time to take action -- but to the specific select ones. While the prospect of investing in Bitcoin may seem daunting, even a small allocation can yield significant returns over the long term. As the world hurtles towards an increasingly digital future, Bitcoin stands poised to become the one and only dominant digital currency, reshaping the global financial landscape in its image.

Bitcoin's ascent to prominence mirrors that of a black hole, pulling in fiat currencies from around the world and reshaping the very fabric of finance. Its immutable nature, combined with its potential for exponential growth, makes it a compelling investment opportunity for individuals seeking to secure their financial future in an uncertain world. As the saying goes, "Buy Bitcoin, and hold on tight—for the journey ahead promises to be nothing short of extraordinary."

- Aspiration

- Banking

- Bitcoin

- Blockchain

- Centralization

- Crypto Asset

- Decentralization

- EĞİTİM BİLGİLERİ

- Fiat Currency

- Inspirational

- SATS

- Technology

- Trade

- Traditional Finance

- Web 3

- Web 5

- Web/Cyber

- Web/Cyber/Hack

- Web Evolution

- Web/Internet

- Web/Wellness

- Web/Internet/Other