-

NEUIGKEITEN

- EXPLORE

-

Blogs

The Pitfalls of Trading: Navigating Emotional Turbulence in the Financial Markets

Trading in the financial markets can be a lucrative endeavor, but it is not without its challenges. Beyond the technical aspects of analyzing charts and understanding market trends, traders often grapple with a host of psychological and emotional hurdles that can significantly impact their decision-making. In this article, we will delve into the various pitfalls that traders may encounter and explore the importance of addressing emotions, fear, and the rush associated with placing or closing trades.

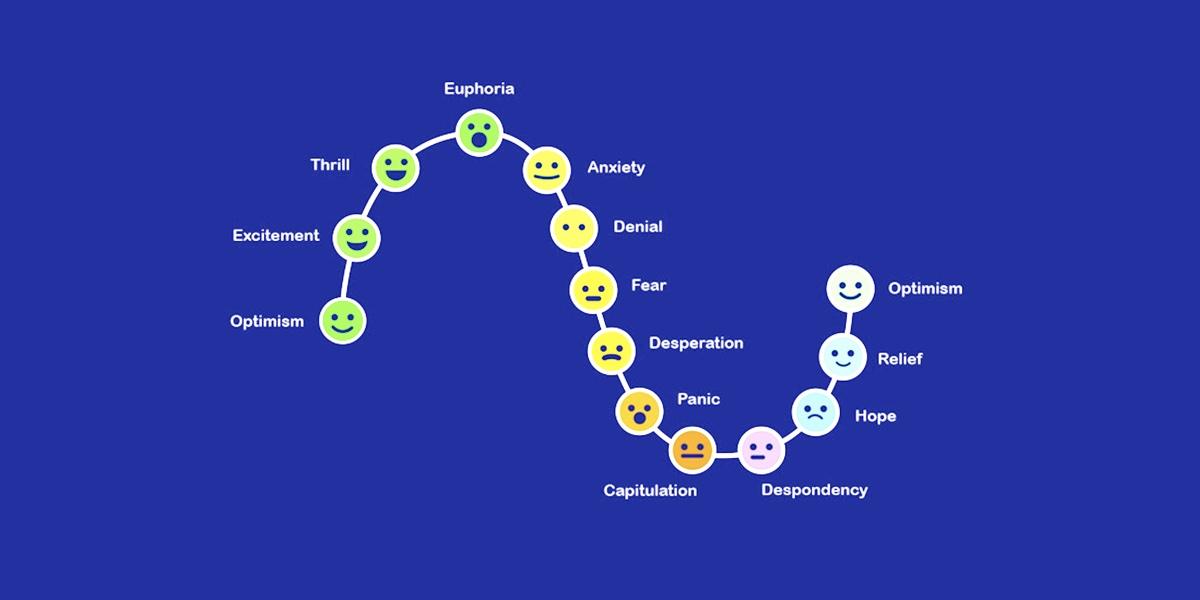

- Emotional Rollercoaster:

One of the primary challenges in trading is managing emotions. The financial markets are inherently unpredictable, and the constant fluctuations can trigger a range of emotions, from excitement to anxiety. Emotional decision-making can lead to impulsive actions, such as entering or exiting trades without a solid rationale. Traders must cultivate emotional intelligence and discipline to navigate the inevitable highs and lows of the market.

- Fear and Greed:

Fear and greed are two powerful emotions that can wreak havoc on a trader's portfolio. Fear of loss may lead to premature exits from winning trades or hesitancy to cut losses on losing positions. On the flip side, unchecked greed can drive traders to take excessive risks or hold onto winning positions for too long, hoping for further gains. Striking a balance and adhering to a well-defined trading plan can help mitigate the impact of these emotions.

- Rushing into Trades:

The fast-paced nature of financial markets can create a sense of urgency that tempts traders to rush into decisions. Whether it's entering a trade without proper analysis or closing a position hastily, impatience can lead to costly mistakes. Establishing a systematic approach, conducting thorough research, and having a predefined set of criteria for trade execution can help traders resist the urge to act impulsively.

- Overtrading:

Overtrading is a common pitfall wherein traders execute an excessive number of trades, often driven by the desire for quick profits. This can result in increased transaction costs, higher risk exposure, and exhaustion. Successful traders recognize the importance of quality over quantity, focusing on well-researched opportunities and avoiding the trap of overtrading.

- Lack of Risk Management:

Failure to implement effective risk management strategies is a critical mistake that traders often make. Without proper risk controls, a single large loss can wipe out a significant portion of a trader's capital. Establishing risk-reward ratios, setting stop-loss orders, and diversifying portfolios are essential components of prudent risk management.

- Confirmation Bias:

Confirmation bias occurs when traders selectively interpret information that aligns with their pre-existing beliefs or desires. This cognitive bias can lead to ignoring warning signs and sticking to losing positions in the hope that the market will eventually move in their favor. Traders should remain open-minded, continuously reassess their positions, and be willing to adapt to changing market conditions.

While trading offers the potential for financial success, navigating the markets requires more than just technical expertise. Emotions, fear, and the temptation to rush decisions are inherent challenges that traders must confront. Developing a disciplined mindset, implementing effective risk management strategies, and maintaining a systematic approach are essential for long-term success in the dynamic world of financial trading. By acknowledging and addressing these pitfalls, traders can enhance their decision-making processes and increase their chances of achieving sustainable profitability.

- Aspiration

- Banking

- Bitcoin

- Blockchain

- Centralization

- Crypto Asset

- Decentralization

- Ausbildung

- Fiat Currency

- Inspirational

- SATS

- Technology

- Trade

- Traditional Finance

- Web 3

- Web 5

- Web/Cyber

- Web/Cyber/Hack

- Web Evolution

- Web/Internet

- Web/Wellness

- Web/Internet/Other