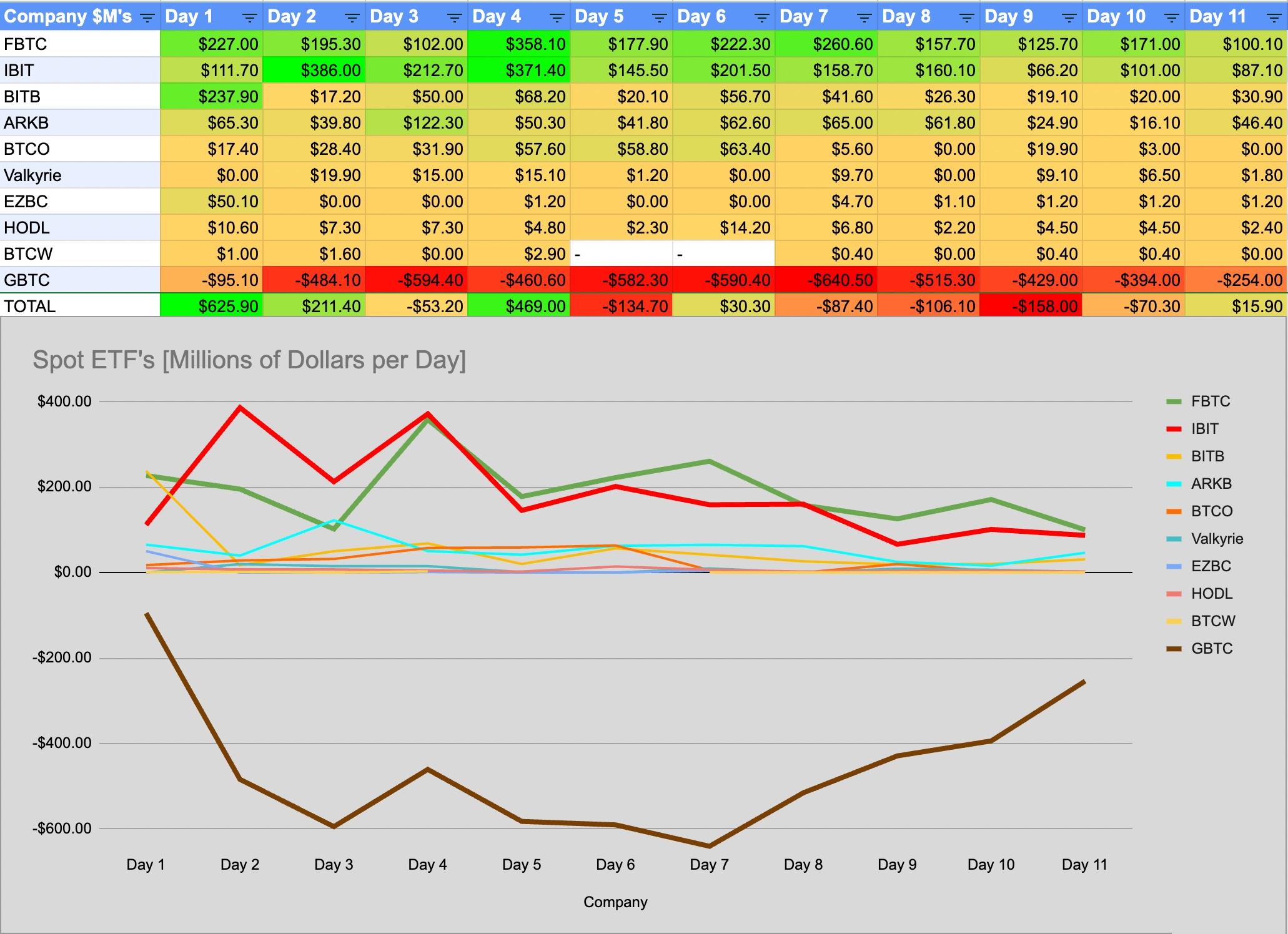

Spot #Bitcoin ETFs have faced significant turmoil due to a persistent streak of outflows, continuing for seven days, with no new inflows throughout the week. This has heightened uncertainty in the Bitcoin community, especially as today's Bitcoin's price has dropped to $54,550, by 10:45am EST marking about a 5% decline over the past week and losing support around the $60,000 level. Major ETF providers like Grayscale, BlackRock, and Fidelity have reported substantial outflows, totaling $211 million on September 5, reflecting growing bearish sentiment among institutional investors. Despite Bitcoin spot ETFs having a total net asset value of about $50 billion since their inception in January, recent stagnation and negative market sentiment have contributed to increased volatility. Additionally, $39.53 million in Bitcoin liquidations over the past 24 hours, primarily from long positions, underscores the challenging market conditions and the dim outlook for a trend reversal in the near term.

Spot #Bitcoin ETFs have faced significant turmoil due to a persistent streak of outflows, continuing for seven days, with no new inflows throughout the week. This has heightened uncertainty in the Bitcoin community, especially as today's Bitcoin's price has dropped to $54,550, by 10:45am EST marking about a 5% decline over the past week and losing support around the $60,000 level. Major ETF providers like Grayscale, BlackRock, and Fidelity have reported substantial outflows, totaling $211 million on September 5, reflecting growing bearish sentiment among institutional investors. Despite Bitcoin spot ETFs having a total net asset value of about $50 billion since their inception in January, recent stagnation and negative market sentiment have contributed to increased volatility. Additionally, $39.53 million in Bitcoin liquidations over the past 24 hours, primarily from long positions, underscores the challenging market conditions and the dim outlook for a trend reversal in the near term.

0 التعليقات

0 المشاركات

8كيلو بايت مشاهدة